Deduct Full Purchase Price

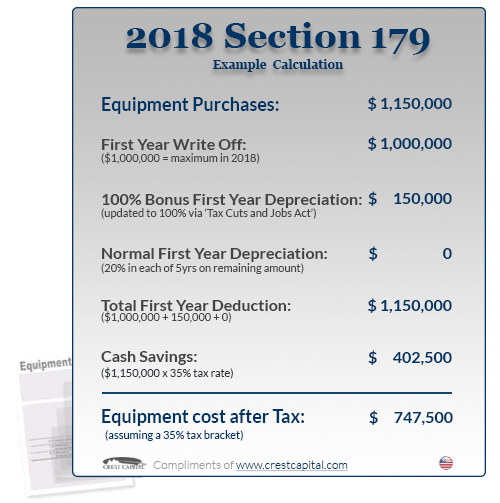

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. That means that if you buy a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. Government to encourage businesses to buy equipment and invest in themselves.

100% Bonus Depreciation

The Reform extends and modifies Bonus Depreciation to allow businesses to immediately deduct 100% of eligible property placed in-service after September 27, 2017, and before January 1, 2023. Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,500,000) on new capital equipment. Also, businesses with a net loss are still qualified to deduct some of the cost of new equipment and carry-forward the loss.

Always check with your financial advisor/accountant to confirm any tax issues or benefits. This information is provided as guidance and is not intended as tax or legal advice. Tax laws are subject to change at any time.

Click for additional information regarding Section 179 visit http://www.section179.org/