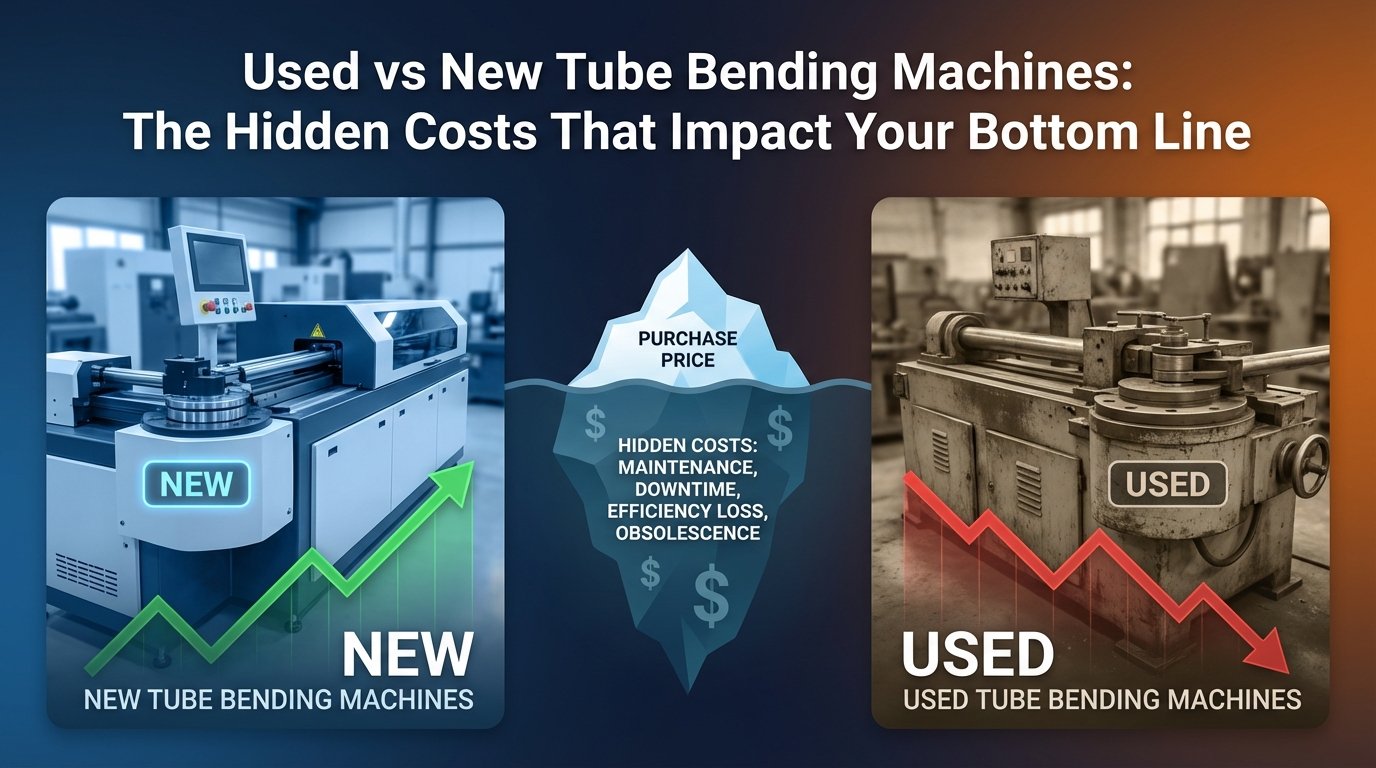

When manufacturing budgets tighten, the appeal of used tube bending machines becomes difficult to ignore. A CNC tube bender that costs $300,000 new might be available used for $100,000—a seemingly compelling 67% savings. But for engineering managers and procurement specialists responsible for equipment investments that must perform reliably for decades, the initial price tag tells only a fraction of the story.

The decision between purchasing used tube bending machines or investing in new equipment represents far more than a simple cost comparison. It’s a complex evaluation of risk tolerance, production requirements, total cost of ownership, and strategic positioning. Understanding the hidden costs associated with used tube bending equipment investment can mean the difference between a smart procurement decision and an expensive mistake that haunts your operation for years.

The True Cost Structure of Manufacturing Equipment Procurement

Total cost of ownership extends far beyond the purchase price. When evaluating tube bending machines for sale, whether used or new, comprehensive financial analysis must account for multiple cost categories that accumulate throughout the equipment’s operational life.

Acquisition Costs Beyond the Price Tag

Used tube bending machines rarely arrive production-ready. Factor in inspection costs, often requiring third-party mechanical and electrical assessments ranging from $5,000 to $15,000 depending on machine complexity. Transportation logistics for older equipment can present unexpected challenges, particularly if the machine lacks current documentation or requires specialized rigging due to modifications made by previous owners.

Installation costs frequently exceed expectations with used equipment. Outdated electrical specifications may require facility upgrades. Mounting configurations might not match your floor layout, necessitating custom foundations. Controls integration with existing production management systems often proves problematic when dealing with discontinued control platforms.

Downtime and Reliability Considerations

The hidden cost that most severely impacts operations is unplanned downtime. New tube bending equipment typically comes with warranty coverage spanning 12 to 24 months, protecting against defects and ensuring rapid manufacturer support. Used machines offer no such safety net.

A single unexpected failure on a critical production line can cost aerospace manufacturers $10,000 to $50,000 per day in lost productivity, missed delivery commitments, and penalty clauses. When the machine in question is a used unit with unknown service history, the probability of such failures increases substantially. Even if the previous owner maintained detailed records—which is rarely the case—wear patterns from their specific applications may not predict performance in your production environment.

Technical Obsolescence and Capability Limitations

Manufacturing technology has advanced dramatically over the past decade. The gap between current CNC tube bender capabilities and machines from even five years ago creates operational constraints that limit competitive positioning.

Control System Evolution

Modern tube bending machines feature advanced controls enabling stack bending, multi-radius bending, and real-time bend correction based on springback characteristics specific to each material and wall thickness combination. These capabilities aren’t simply convenient—they’re essential for meeting current aerospace and defense specifications where tolerances have tightened considerably.

Used equipment typically runs on legacy control platforms. Software updates may no longer be available. Integration with CAD/CAM systems requires custom programming that costs $20,000 to $75,000, assuming it’s even possible. Many older controls lack the processing power for advanced algorithms that compensate for material property variations.

Material Compatibility Challenges

Today’s aerospace and petrochemical applications increasingly specify advanced materials—titanium alloys, Inconel, duplex stainless steels, and high-strength low-alloy compositions that didn’t exist or weren’t common when older machines were manufactured. These materials exhibit different springback characteristics, work hardening behaviors, and mandrel requirements.

Used tube bending machines may lack the frame rigidity, servo responsiveness, and pressure control precision necessary for these demanding materials. Attempting to bend modern alloys on equipment designed for mild steel or aluminum often results in unacceptable scrap rates, potentially 15% to 40% compared to 2% to 5% on purpose-built modern equipment.

Support Infrastructure and Knowledge Transfer

When evaluating tube bending equipment investment, the manufacturer’s ongoing support capability represents a critical yet often undervalued factor.

Parts Availability and Lead Times

New equipment comes with guaranteed parts availability and established supply chains. Manufacturers maintain comprehensive inventories of wear components, electronics, and assemblies. When a pressure die cracks or a servo drive fails, replacement parts ship within days.

Used machines present an entirely different scenario. If the equipment is more than ten years old, critical components may be discontinued. Finding replacement parts requires searching salvage markets, commissioning custom manufacturing, or attempting retrofits with non-original components that compromise performance. A $300 part that’s unavailable can idle a machine for weeks while alternatives are engineered and fabricated—costs that dwarf any initial purchase savings.

Training and Process Development Support

American manufacturers like Hines provide comprehensive training programs covering setup procedures, tooling selection, maintenance protocols, and troubleshooting methodologies. This knowledge transfer accelerates time-to-productivity and reduces the learning curve that typically costs manufacturers 3 to 6 months of suboptimal performance.

Purchasing used tube bending machines means this support infrastructure disappears. You’re acquiring hardware without the accumulated process knowledge that makes it productive. Operator training becomes trial-and-error, consuming material and time while increasing safety risks. For complex applications in oil & gas or aerospace where bend quality directly impacts system integrity, this knowledge gap creates unacceptable risk.

Competitive Positioning and Customer Requirements

Manufacturing equipment procurement decisions affect more than internal operations—they influence market competitiveness and customer qualification status.

Certification and Audit Considerations

Aerospace and defense contracts often require AS9100 or NADCAP certification. Audit requirements include equipment qualification, process validation, and traceability documentation. New equipment arrives with full documentation packages, material certifications for all wetted components, and calibration records traceable to NIST standards.

Used machines typically lack comprehensive documentation. Previous owners may not have maintained calibration records to auditable standards. Qualifying used equipment for critical applications requires extensive testing and documentation development, often costing $25,000 to $100,000 depending on the application complexity and material specifications involved.

Technology Roadmap Alignment

Forward-thinking manufacturers align equipment investments with strategic technology roadmaps. Industry trends point toward increased automation, data analytics for predictive maintenance, and integration with digital manufacturing ecosystems. New tube bending equipment incorporates connectivity enabling Industry 4.0 initiatives—collecting production data, monitoring tool wear, and interfacing with enterprise resource planning systems.

Used machines lack these capabilities entirely. As customers increasingly demand data-rich quality documentation and real-time production visibility, equipment that can’t provide this information becomes a competitive liability rather than an asset.

The New Equipment Value Proposition

Understanding CNC tube bender cost requires looking beyond sticker prices to lifetime value creation. New equipment delivers multiple advantages that compound over operational life.

Warranty Protection and Risk Mitigation

Comprehensive warranty coverage protects against defects while providing predictable budgeting for the critical first years of operation. Manufacturer support ensures rapid response to issues, minimizing production disruptions during the learning curve period when operators are developing process expertise.

Latest Technology and Future-Proofing

New machines incorporate current best practices in precision bending—servo-electric drives for repeatable positioning, advanced mandrel technologies for tight radius bends, and software capabilities that will remain relevant for 15 to 20 years. This longevity matters significantly when calculating return on investment across the equipment’s useful life.

Customization for Specific Applications

Manufacturers like Hines, with proven track records serving NASA and military applications, offer custom engineering to optimize machines for specific production requirements. This application-specific design ensures the equipment performs optimally for your exact tube sizes, materials, bend radii, and production volumes from day one—capability rarely achievable with used equipment originally configured for someone else’s applications.

Energy Efficiency and Operating Costs

Modern tube bending machines incorporate energy-efficient hydraulic systems, regenerative drives, and optimized idle modes that reduce electrical consumption by 30% to 50% compared to equipment manufactured before 2015. Over a 20-year operational life, these savings can total $50,000 to $200,000 depending on machine size and utilization rates.

Making the Strategic Decision

The choice between used and new tube bending equipment depends on specific operational contexts. Used machines might suit low-volume job shops with experienced technicians capable of maintaining older equipment and working around limitations. However, for manufacturers serving demanding industries like aerospace, petrochemical, defense, or energy—where quality, reliability, and traceability are non-negotiable—new equipment represents the only viable path forward.

Consider your production requirements honestly. If you need consistent quality, minimal downtime, comprehensive support, and equipment that qualifies for critical applications while positioning your operation competitively for the next two decades, the apparent savings of used tube bending machines evaporate under scrutiny.

Partner With Proven American Manufacturing Excellence

For over six decades, Hines has delivered precision tube and pipe bending solutions to America’s most demanding industries. Our equipment serves NASA missions, military applications, and critical infrastructure projects where failure isn’t an option. We don’t just sell machines—we provide complete solutions including engineering support, operator training, tooling design, and ongoing service that ensures your investment delivers value throughout its operational life.

Before making your next tube bending equipment investment decision, talk with specialists who understand the true cost implications and can provide unbiased guidance based on your specific requirements. Contact Hines today to discuss how new, American-manufactured equipment custom-configured for your applications provides the reliability, performance, and long-term value your operation demands.